Reference: Property curbs may be 'eased faster if prices drop sharply': Straits Times

Property prices ought fall by up to 38% to match 2009 (pre-financial crisis) prices.

("private home prices have climbed about 60% since the global financial crisis in 2009."), so for current property prices to return to pre-2009 prices, the price will have to FALL by= 1- (100/160)= 37.5%.

Okay, maybe I forgot to factor in inflation at say 2.5% p.a. (pegged to CPF rate) which will mean that the reasonable FY2014 property price level (5yrs after FY2009) should be 113.14% in FY2009dollars (used compound interest calculator to calculate), so for current property prices to return to pre-2009 prices (corrected for (high) annual inflation of 2.5%), the price will have to FALL by= 1- (113.14/160)= 29.287%.

Property prices ought fall by up to 38% to match 2009 (pre-financial crisis) prices.

("private home prices have climbed about 60% since the global financial crisis in 2009."), so for current property prices to return to pre-2009 prices, the price will have to FALL by= 1- (100/160)= 37.5%.

Okay, maybe I forgot to factor in inflation at say 2.5% p.a. (pegged to CPF rate) which will mean that the reasonable FY2014 property price level (5yrs after FY2009) should be 113.14% in FY2009dollars (used compound interest calculator to calculate), so for current property prices to return to pre-2009 prices (corrected for (high) annual inflation of 2.5%), the price will have to FALL by= 1- (113.14/160)= 29.287%.

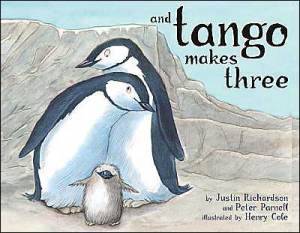

...Are you here to promote a gay cause again....We had enough of these lah....we need more pro family stories not another gender bender pls......

...Are you here to promote a gay cause again....We had enough of these lah....we need more pro family stories not another gender bender pls......

(

(