A Simple dichotomy to understand the 2 principle causes of inflation.

Just by my simple observation, though I'm no qualified 'economist'.

Firstly, the definition of inflation [wiki]: "In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time."

On the same wiki page about inflation, it is stated that "Economists generally agree that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply."

Thus my simple conclusion that we should understand inflation in 2 forms: the first being 'fiscal/ currency expansion' inflation and the 2nd being 'non-fiscal (non-currency expansion based)' inflation.

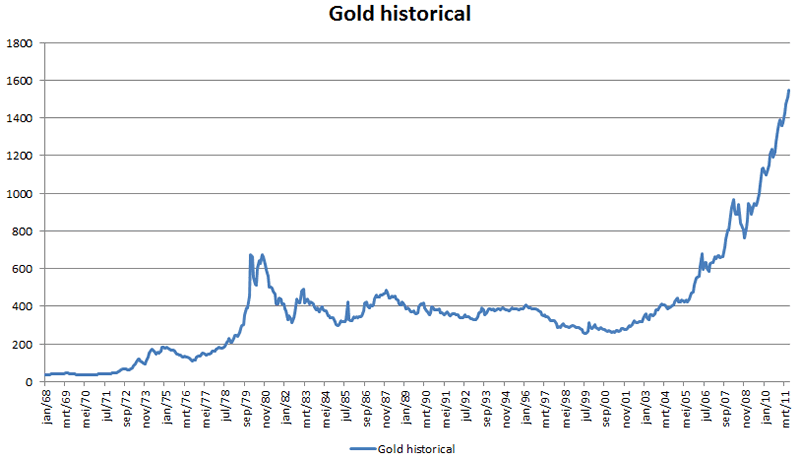

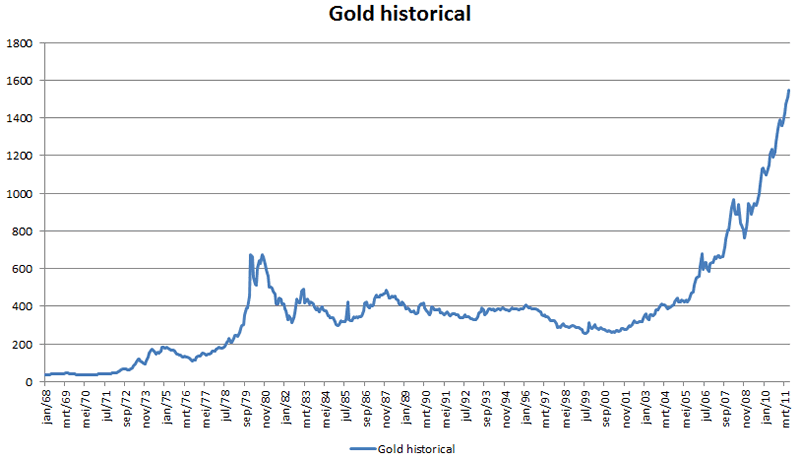

The key reason for this dichotomy is that one must understand that none of the currencies in use in the world today are tagged to gold, a situation progressively arrived at since USA partially left the gold standard in approx 1934 (due to WWII expenditure) and then totally with the collapse of the Bretton Woods system [wiki] (other economic reasons) in Aug15,1971.

Where under the gold standard of currency issuance, central banks were obliged to exchange dollars issued for pure gold bullion at a preset promised rate, there is no longer any such obligation to do so nowadays since the demise of the Bretton Woods system [wiki] and by extension: any form of equivalence to a 'gold standard' currency agreement- parliaments and by extension- governments, are now able to print any amount of monies as they deem fit/ as the electorate seem to dictate according to the results of general elections- rigged or otherwise.

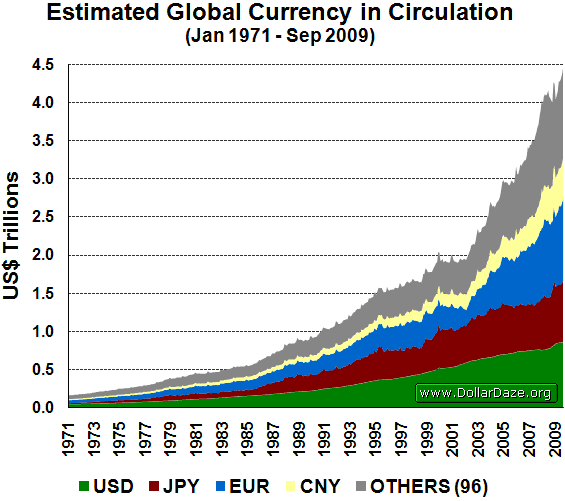

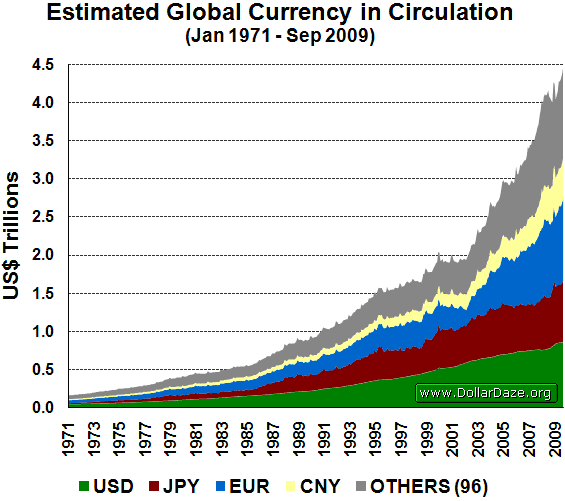

For instance, China is obviously printing yuan to combat the effect of USA's quantitative easing [wiki] so as to artificially make China made goods relatively cheaper as the Chinese government resist an inflation in the price of the Yuan by simply printing more yuan notes (or bond slips) into circulation.

Thus with the exception of gold which might be considered as well a currency (but cannot be printed), most if not all currencies around the world appear to have 'stable' exchange rates against the USD since every dollar printed by the FED generally legitimizes another printed by a central bank in every other country including China- some falls in exchange rates e.g. India, Indonesia and recently Vietnam[Business report 14Feb2012 (Gold fever)] being the consequence of either poor economic policy or else blatant government corruption/ the over relaxation of monetary policy[wiki].

The primary cause of currency expansion is due to unbalanced budgets whereby government tax revenue is insufficient to cover for government expenditure due to wars, corruption, poor economic policy etc. Resulting in government debt[wiki] which then only serves to place more burden on government expenditure as then interest becomes and additional government liability on top of the debt already incurred.

Much of the excess monies (earned as interest on their bond holdings) by the rich/ pension funds would then be spent on various goods and services: e.g. property, gold and other forms of equity resulting in the inflation in prices of these items, and later perhaps food/ daily necessities since at current state, since no country in the world, with the exception of Singapore and its 'dictatorial' ultra-capitalistic economic policies and servile workforce seems to be having a positive government budget year after year.

The other cause of inflation (non-currency related) would be everything else unrelated to currency: e.g. where the price of oil increased due to instability in the gulf region.

In conclusion, inflation should be defied as primarily having 2 causes, fiscal (currency supply) and non-fiscal for a better understanding on the causes, outcomes and various solutions towards the remedy of such problematic high inflation situations.

[pict source]

[pict source]

[pict source]

[pict source]

Just by my simple observation, though I'm no qualified 'economist'.

Firstly, the definition of inflation [wiki]: "In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time."

On the same wiki page about inflation, it is stated that "Economists generally agree that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply."

Thus my simple conclusion that we should understand inflation in 2 forms: the first being 'fiscal/ currency expansion' inflation and the 2nd being 'non-fiscal (non-currency expansion based)' inflation.

The key reason for this dichotomy is that one must understand that none of the currencies in use in the world today are tagged to gold, a situation progressively arrived at since USA partially left the gold standard in approx 1934 (due to WWII expenditure) and then totally with the collapse of the Bretton Woods system [wiki] (other economic reasons) in Aug15,1971.

Where under the gold standard of currency issuance, central banks were obliged to exchange dollars issued for pure gold bullion at a preset promised rate, there is no longer any such obligation to do so nowadays since the demise of the Bretton Woods system [wiki] and by extension: any form of equivalence to a 'gold standard' currency agreement- parliaments and by extension- governments, are now able to print any amount of monies as they deem fit/ as the electorate seem to dictate according to the results of general elections- rigged or otherwise.

For instance, China is obviously printing yuan to combat the effect of USA's quantitative easing [wiki] so as to artificially make China made goods relatively cheaper as the Chinese government resist an inflation in the price of the Yuan by simply printing more yuan notes (or bond slips) into circulation.

Thus with the exception of gold which might be considered as well a currency (but cannot be printed), most if not all currencies around the world appear to have 'stable' exchange rates against the USD since every dollar printed by the FED generally legitimizes another printed by a central bank in every other country including China- some falls in exchange rates e.g. India, Indonesia and recently Vietnam[Business report 14Feb2012 (Gold fever)] being the consequence of either poor economic policy or else blatant government corruption/ the over relaxation of monetary policy[wiki].

The primary cause of currency expansion is due to unbalanced budgets whereby government tax revenue is insufficient to cover for government expenditure due to wars, corruption, poor economic policy etc. Resulting in government debt[wiki] which then only serves to place more burden on government expenditure as then interest becomes and additional government liability on top of the debt already incurred.

Much of the excess monies (earned as interest on their bond holdings) by the rich/ pension funds would then be spent on various goods and services: e.g. property, gold and other forms of equity resulting in the inflation in prices of these items, and later perhaps food/ daily necessities since at current state, since no country in the world, with the exception of Singapore and its 'dictatorial' ultra-capitalistic economic policies and servile workforce seems to be having a positive government budget year after year.

The other cause of inflation (non-currency related) would be everything else unrelated to currency: e.g. where the price of oil increased due to instability in the gulf region.

In conclusion, inflation should be defied as primarily having 2 causes, fiscal (currency supply) and non-fiscal for a better understanding on the causes, outcomes and various solutions towards the remedy of such problematic high inflation situations.

[pict source]

[pict source] [pict source]

[pict source]=============

At/related:

A1:

14Feb2012: A Simple dichotomy to understand the 2 principle causes of inflation.

HWZ:14Feb2012: A Simple dichotomy to understand the 2 principle causes of inflation.

SBY:

14Feb2012: A Simple dichotomy to understand the 2 principle causes of inflation.

SGforum

14Feb2012: A Simple dichotomy to understand the 2 principle causes of inflation.

14Feb2012: A Simple dichotomy to understand the 2 principle causes of inflation.

14Feb2012: A Simple dichotomy to understand the 2 principle causes of inflation.

No comments:

Post a Comment